reverse sales tax calculator ny

Avalara calculates collects files remits sales tax returns for your business. If the purchase comes to 100 the sales tax in New York City would be 850 100 x 00850.

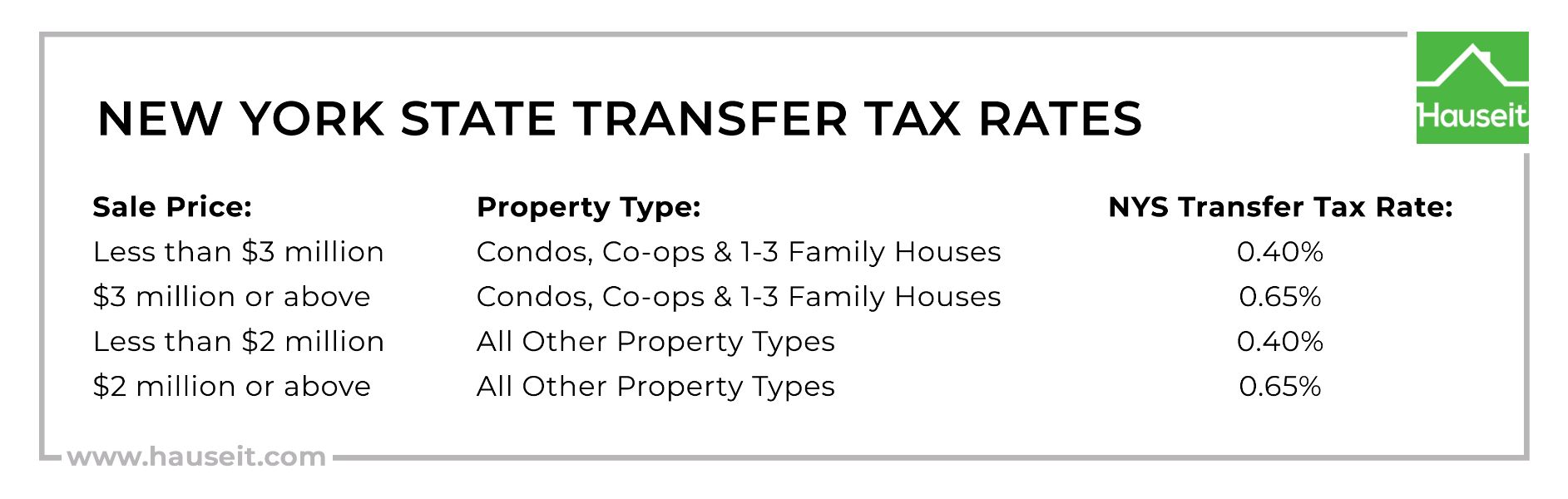

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

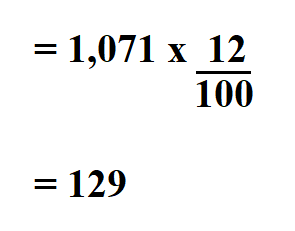

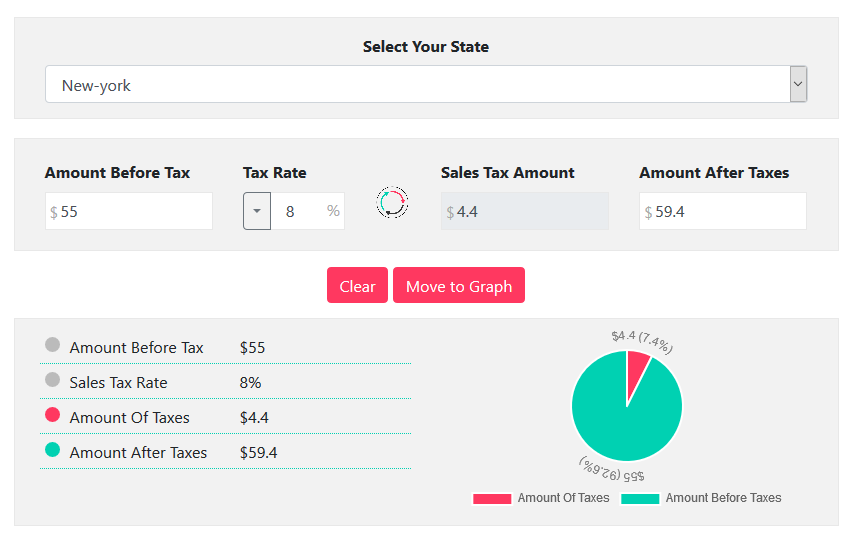

Sales Tax Rate Sales Tax Percent 100.

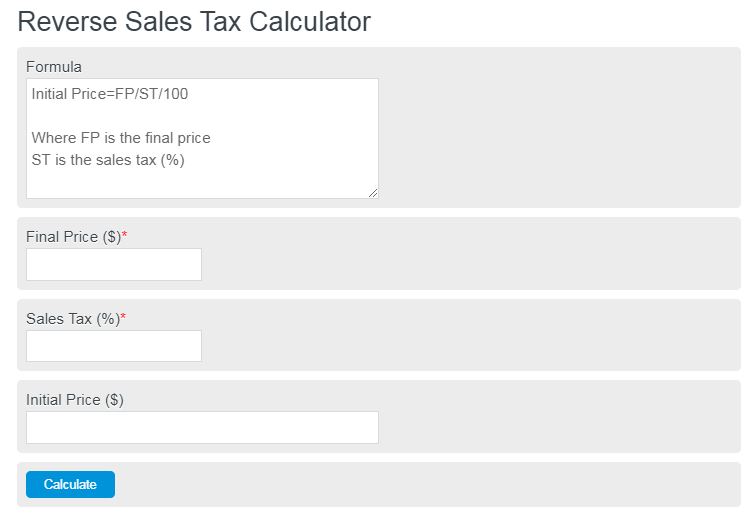

. The New York State Transfer Tax is 04 for sales below 3 million and 065 for sales of 3 million or more. These numbers help explain why sales tax compliance is so complicated. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Us Sales Tax Calculator Reverse Sales Dremployee A sales tax is a consumption tax paid to a government on the sale of certain goods and services. For taxpayers in the state of New York theres New York City and then theres everywhere else. The Mansion Tax in NYC is a progressive buyer closing cost which ranges from 1 to 39 of the purchase price on sales of 1 million or more.

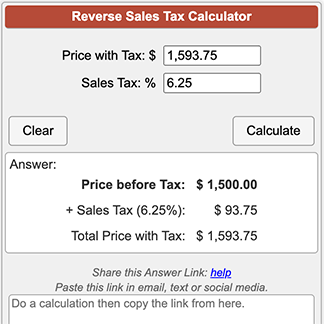

For tax years before 2018 you have until October 15th of the year after making a conversion to reverse it and avoid the related tax liability. New York Sales Tax Rate. Reverse Sales Tax Calculator.

Used Vehicles for Sale in Bayside NY. Multiply the result from step one by the tax rate to get the dollars of tax. Sales tax rates product taxability rules and regulations differ.

See the article. Sales Tax total value of sale x Sales Tax rate. This is the amount that the government will collect in taxes on that purchase.

There is a state sales tax as well as by city county or school district rates. Before-tax price sale tax rate and final or after-tax price. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

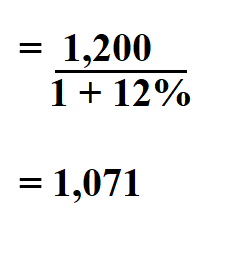

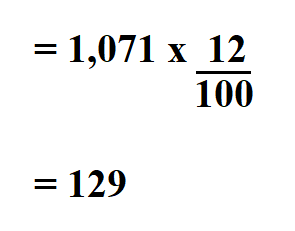

Price before Tax Total Price with Tax - Sales Tax. Tax reverse calculation formula. Tax rate for all canadian remain the same as in 2017.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. When trying to determine how much sales tax to add to a transaction and whether or not a certain item should be taxed it is important to review your local tax rate and laws regarding what is taxable.

4 plus any local tax rate imposed by city county or school district typically between 3-5. This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

Amount without sales tax GST rate GST amount. Why A Reverse Sales Tax Calculator is Useful. On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

4Maximum rate for local municipalities. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254 on top of the state tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts.

Current HST GST and PST rates table of 2022. New York on the other hand only raises about 20 percent of its revenues from the. The harmonized sales tax or hst.

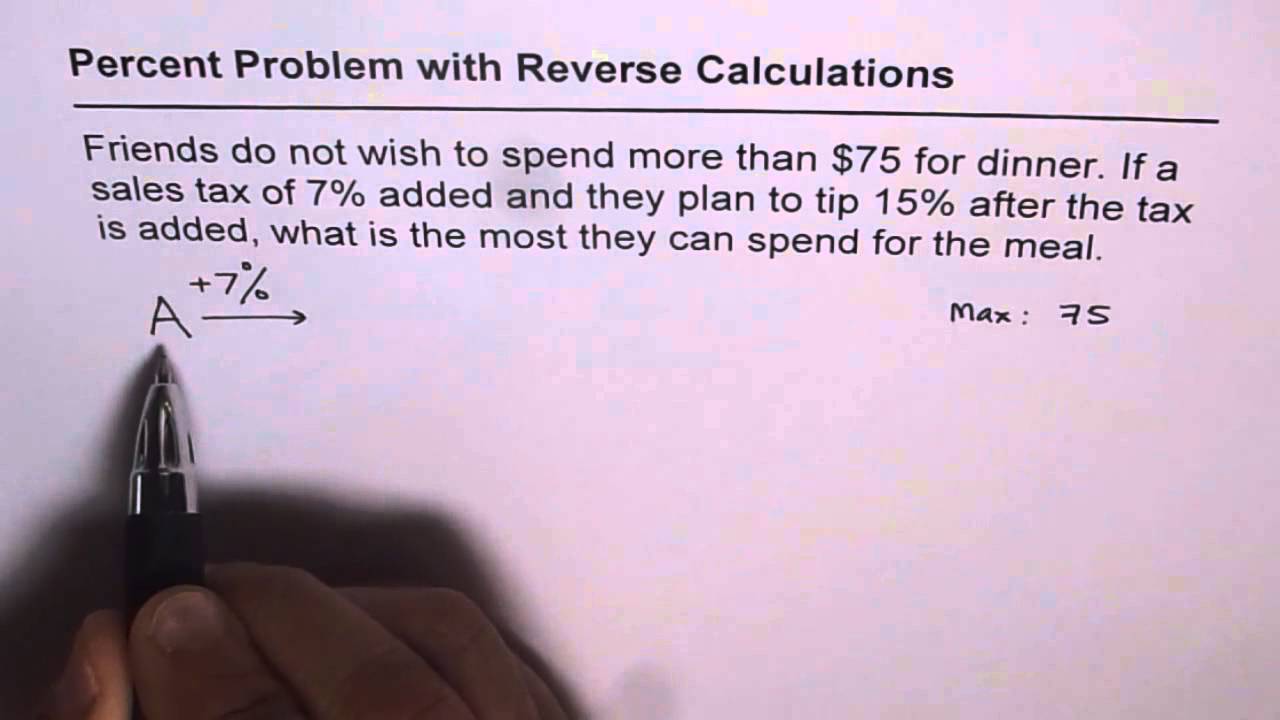

Here is the Sales Tax amount calculation formula. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. This reverse sales tax calculator will calculate your pre-tax price or amount for you.

Reverse Sales Tax Calculations. Amount without sales tax QST rate QST amount. Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. Here is how the total is calculated before sales tax. And several of these states raise nearly 60 percent of their tax revenue from the sales tax.

See it in Action. The higher rate of 065 kicks-in at a lower threshold of 2 million for commercial transactions and residential properties with 4 or more units. New York Sales Tax Rate.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

How To Calculate Sales Tax Backwards From Total Reverse Tax Calculator

How Much Is The Nyc Transfer Tax Hauseit Reviews Nyc

Reverse Sales Tax Calculator De Calculator Accounting Portal

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Recovery Reverse Sales Tax Audit Pmba

New York Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator Calculator Academy

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Amount With Percent Tax And Tip With Reverse Calculations Youtube